does doordash do quarterly taxes

How Do Taxes Work On Doordash. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation.

Tips For Filing Doordash Taxes Silver Tax Group

We file those on or before April 15 or later if the government.

. IRS will come knocking if. DoorDash does not automatically withhold taxes. Just make sure that theyre not already being reimbursed to you by Doordash.

Do I have to pay quarterly taxes for DoorDash. The only real exception is that the Social. Youll get an email from a company called Stripe.

Federal income and self-employment taxes are annual. Well You estimate the taxes that will be owing on your earnings. There are no tax deductions or any of that to make it complicated.

Make quarterly payments of 15 of your net income. There isnt a quarterly tax for 1099 Doordash couriers. Paper Copy through Mail.

The forms are filed with the US. Its a straight 153 on every dollar you earn. There is no quarterly tax youll get at 1099 at the beginning of next year.

You can also use the IRS website. This should be an easy fraction to compute and cover you unless you. Every mile driven on the job saves you about eight cents in taxes.

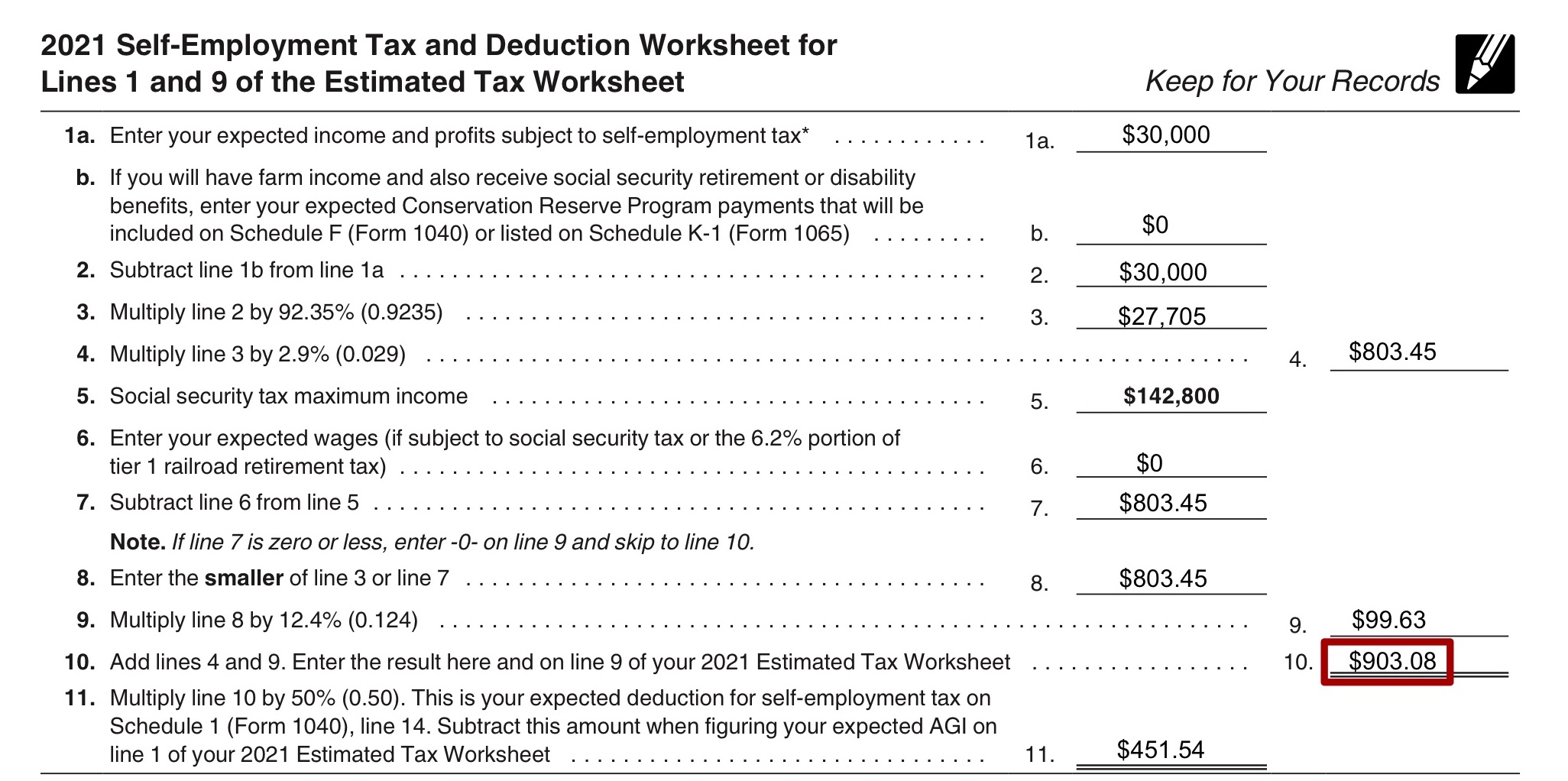

Do you owe quarterly taxes. Since youre an independent contractor you might be responsible for estimated quarterly taxes. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153.

A 1099-NEC form summarizes Dashers earnings as independent. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash. If you made 5000 in Q1 you should send in a Q1.

It may take 2-3 weeks for your tax documents to arrive by mail. Then file your taxes. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

Toll fees that you pay while you drive for Doordash are tax-deductible. A 1099 form differs from a W-2 which is the standard form issued to. Instructions for doing that are available through the IRS using form 1040-ES.

Answer 1 of 4. Does California Have An Inheritance Tax. No tiers or tax brackets.

However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability. Internal Revenue Service IRS and if required state tax departments. If you will owe money on taxes this year you really want to think about getting a payment sent in by tomorrow if you havent already done so.

The process of figuring out your DoorDash 1099 taxes can feel overwhelming from expense tracking to knowing when your quarterly taxes are due. Youll click a link from stripe and get your 1099. Since DoorDash earnings are treated essentially the same.

This is the reported income a Dasher will use to file.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Pro Door Dasher Shares Tips To Maximize Your Earnings

Self Employed Tax Walkthrough 2021 Doordash Grubhub Uber Etc Youtube

How Do I File Estimated Quarterly Taxes Stride Health

/images/2019/12/11/essential_guide_to_quarterly_taxes.jpg)

The Essential Guide To Quarterly Taxes 2022 Financebuzz

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Doordash 1099 How To Get Your Tax Form And When It S Sent

Doordash Taxes Does Doordash Take Out Taxes How They Work

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Do Doordash Contractors Pay Quarterly Taxes Entrecourier

How To Make Quarterly Estimated Tax Payments

Doordash Dash Q1 2021 Earnings Miss Estimates

Tips For Filing Doordash Taxes Silver Tax Group

The Best Guide To Paying Quarterly Taxes Everlance

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Doordash S Q2 Orders Hit Record High But Revenue Gains Slow Krqe News 13